Small business owners globally have had to become financial experts and disaster management pro’s overnight, due to the rapid effects of COVID-19 and governmental lockdowns. In South Africa, we have our own set of challenges and backup plans. To make it a bit simpler, we have compiled this list of relief/loan opportunities for small businesses so you can locate applications and information and apply where you qualify.

Updates to links and information may occur. We will update this page as we learn more.

How Yoco can help your applications

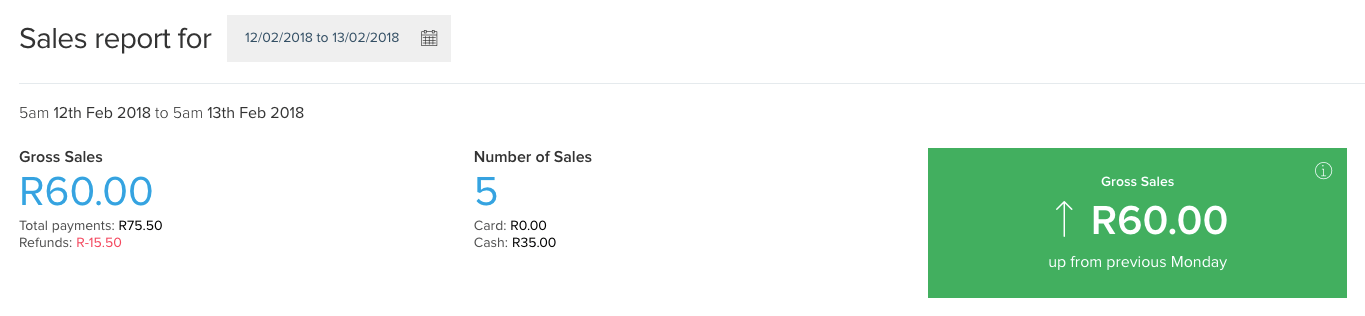

Yoco Merchants are able to use their sales reports to indicate loss of revenue as a direct result of the COVID-19 pandemic by using time period comparison reports. You can download your sales reports from inside the Yoco Business Portal here.

Alternatively, you can contact our Support team who are standing by to guide you through the process.

Click here for a step-by-step guide.

South African Government SMME funding and Debt Relief

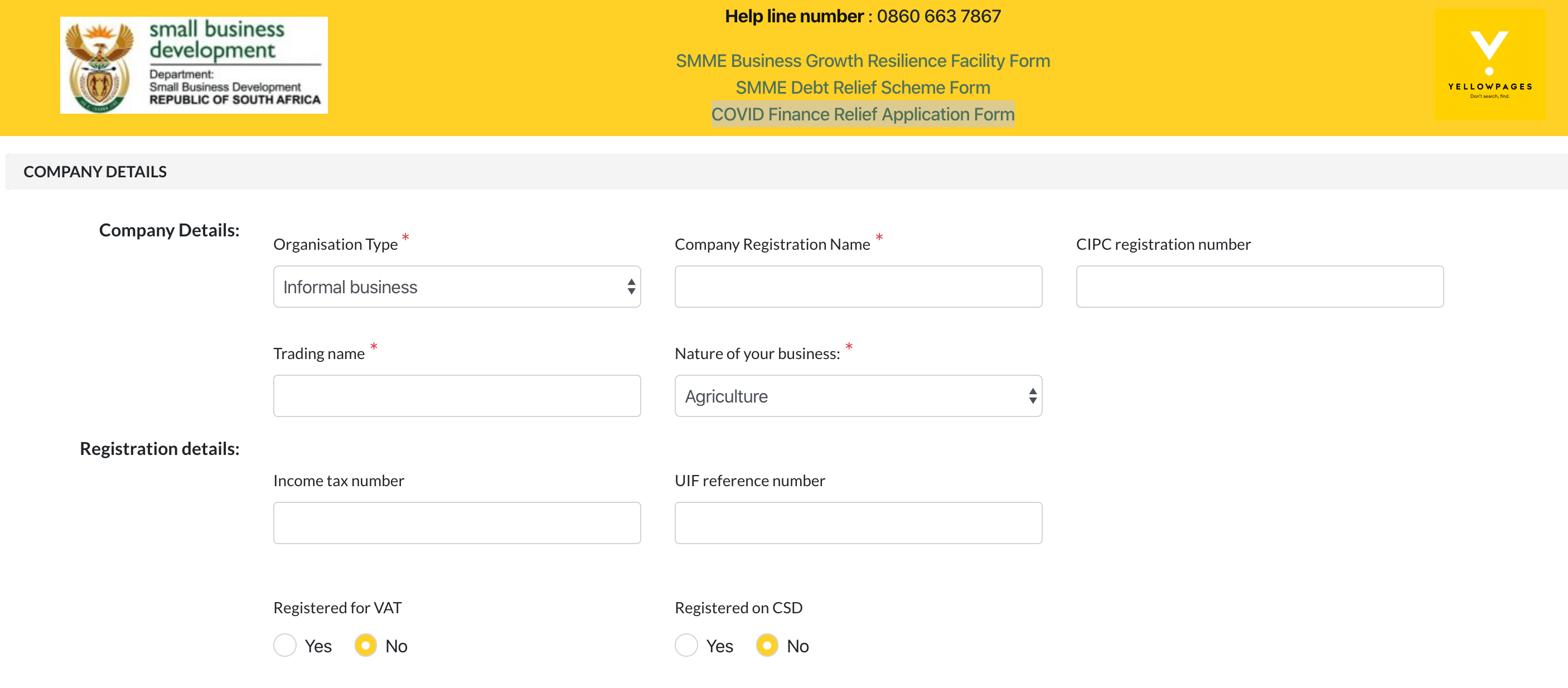

The Department of Small Business development announced a number of interventions for small businesses including a Debt Relief Financing Scheme and Growth Resilience Facility.

Applications have been overwhelming with 81 000 SMMEs applying thus far.

The COVID-19 interventions measures include: SMME Relief Finance Schemes, Business Growth and Resilience Facility, Restructuring of SEFA-funded loans and Informal Sector address. Register your business online to begin the application process.

The relevant forms are made available once you have registered.

You can read more about state relief measures especially support for spaza shops and informal sector businesses here.

General SMME Funding and Relief

The Solidarity Response Fund was one of the first safety nets put in place to aid small businesses and people in need during COVID-19 and the 21 day lockdown.

Mary Oppenheimer and daughters, as well as Patrice Motsepe and associated companies, have pledged to donate R1 billion each towards the fund. Listed technology investor Naspers will contribute R500 million to the Solidarity Response Fund too. Individuals and businesses who can have been encouraged to donate to the fund. You can contact info@solidarityfund.co.za for more information.

Johann Rupert’s fund, the Sukuma Relief Programme, to which he pledged R1 billion received over 10 000 applications in three days and has since closed for applications. The fund is made up of two separate relief offerings – one for formal sole proprietors and another for close corporations, companies and trusts.The financial aid and assistance would comprise grants and low-interest-bearing loans with a 12-month repayment holiday. Although the fund is closed for now, applications may reopen as the purpose of the programme is to continue stimulating growth during and after the pandemic.

Formal Sole Proprietors and CC’s, Companies and Trusts can apply for the Sukuma Relief Programme online here should applications re-open.

South Africa Future Trust

The South African Future Trust (“SAFT”) is an independent trust set up by Nicky and Jonathan Oppenheimer, in partnership with the South African government and private sector. Its immediate purpose is to extend financial assistance to employees of South African small to medium businesses who are at risk of losing their jobs or will suffer a loss of income because of COVID-19.

During this initial COVID-19 period, the funds will be disbursed as interest-free loans over a five-year term. If you bank with one of the following banks, contact them to find out more about eligibility and applications. For example, FNB are currently processing applications through their app once an SME assessment has been completed.

- Absa

- FNB

- Investec

- Mercantile Bank

- Nedbank

- Standard Bank

Industry-specific SMME Funding and Relief

The South African National Taxi Council (SANTACO) have launched a R3.5 billion COVID-19 relief fund. This fund will compensate workers in the industry. It aims to help 100 000 queue marshals, 150 000 taxi drivers, and the taxi associations’ support staff whose livelihoods have been compromised by the Coronavirus pandemic.

The Youth Business Relief Fund “will assist youth entrepreneurs from operational costs, paying labour costs, rental”. Apply online here.

For people working in the tourism industry, a COVID-19 Tourism Relief Fund has been put in place. Applications are open, apply online here.

Relief funds, criteria, and application processes

In addition to these, there are a number of other targeted relief funds. This PDF summarises COVID-19 interventions to date, the criteria for qualification and the method of application.