Carl Wazen, Yoco co-founder and Chief Business Officer, recently spoke at the South African Coffee Leader Summit about providing technology to small businesses as a way to grow the market. He shared how Yoco is using technology and data to grow the economy as a whole, and the coffee industry specifically.

Why small business?

Here at Yoco, we want to amplify small businesses using smart technology. By smart technology we mean intelligent and easy to use interfaces and an integrated system that syncs seamlessly to the cloud. We want to help businesses do what they do, better.

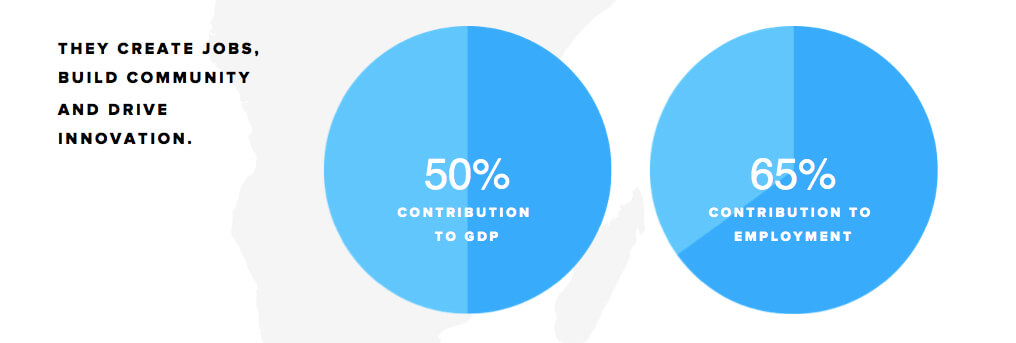

Small businesses are at the heart of the African economy. Growth is largely driven by SMB’s and the only way to sustain this is to empower these entrepreneurs.

But they are faced with daily challenges. Getting paid is a challenge as card payment systems are generally aimed towards larger, more established businesses.

Another big challenge is getting organised. The classification of a formal vs informal business is largely determined by how the business tracks their efforts and keeps records. Without getting paid using non-cash methods and without tracking efforts with digital records, it’s tricky to get access to capital to fund and grow your business.

How does Yoco use technology to amplify small business?

Yoco is a technology business that builds tools to help businesses get paid, run more efficiently and grow. We have created our ecosystem specifically with this in mind.

Three quarters of the businesses using Yoco have never accepted card payments before. We knew that we had to come up with a completely fresh approach by lowering the cost to accept payments. To do this, we’ve innovated.

Quick and easy set up and use

To get Yoco you sign up on our website in 10 minutes and have your card reader delivered to you within 5 days. The business owner then downloads the Point of Sale App from the Google Play or Apple App store and is ready to accept payments.

Payments are quick and mobile and there are no monthly fees. This allows us to be inclusive and accessible to even first time entrepreneurs with no trading history. An entrepreneur looking to start up a mobile coffee trailer can start accepting card payments in one week, and transact wherever the trailer takes them.

No monthly fees

The current model that traditional financial institutions employ means that if you process less than a certain amount in card transactions a month, you are not able to afford to rent a card machine. This excludes a large portion of the market because you’re not able to equip people who want to start a coffee business from scratch. Our pay-as-you-use model was created with the aim of making it financially viable for smaller businesses to start accepting payments.

An integrated system

The payments accepted through the Yoco card machine sync in real-time to the Yoco Point of Sale App, which in turn syncs to the cloud. This allows for a seamless checkout experience, faster cash up and more control over your business. An entrepreneur who needs to step out of their coffee shop for a meeting can still keep an eye on what’s happening in their business and the sales that are being made.

Yoco also integrates into leading hospitality (TabletPOS) and retail (Vend) Point of Sale software, making it accessible to not only smaller business, but more established ones too.

Real time data and insights and control

Because Yoco is mobile and cloud-based, business owners can access their data from anywhere. The Yoco Business Portal provides real-time insights on the performance of your business in a single place, in a way that’s easy to understand and action. Coffee shops can see exactly how many cups they’ve sold, which coffees sell the best and adjust their strategies accordingly.

Encouraging diversity and inclusivity in the coffee industry

A big part of what we’re doing at Yoco is promoting diversity and inclusivity in the economy. In the coffee industry this is about getting quality coffee businesses into areas that have not previously had access, by providing them with the tools to run their businesses better.

Gcobani started Barista Cup by hand roasting beans in his township home. He served taxi drivers at a busy intersection in Nyanga junction at an affordable price, a market which previously did not have premium coffee. Barista Cup has since grown to doing events and a permanent store at CPUT. They use Yoco to accept payments and track sales.

Partnering with coffee shops made us a better company

Since we started Yoco we have more than 500 coffee shops using our solution, with over 2 million coffee cups sold to date.

We have learnt and grown from these businesses in two major ways:

1. Coffee shops are community builders. They have plugged us into the SMB community.

Yoco is a young business, and when we started we didn’t have massive budgets to advertise.

Coffee shops are a good way to enter the SMB space. They are essentially the community builders and a space for entrepreneurs to converge for coffee, meetings, and at times a place to run their business. They’re a place where a diverse range of people converge in high volumes.

When we got our first few coffee shops on board, the requests for Yoco started to pour in.

When we signed up our first ten or so brands in the coffee industry in Cape Town, people would come up to me and say ‘I’ve seen Yoco everywhere.’ We were just in the right places, which created the perception that we were everywhere.

Carl Wazen, co-founder and Chief Business Officer, Yoco

2. The fast-paced coffee industry forced us to improve the speed, quality and uptime of the Yoco solution.

When we started Yoco, we went through rigorous testing and ran an extensive beta programme. By focussing on coffee shops, we put ourselves in an environment that was quite high paced and challenging. This helped us learn quickly and jack up our systems.

We were able to increase our transaction speed and really make sure that the customer experience was great by decreasing the time it takes to process a transaction. The card machine faces the customer on a stand, and the business owner or employee doesn’t need to touch it to process the transaction. We learnt that getting the customers to do things themselves allowed us to shave off seconds from the interaction. This speeds up queues and saves time.

There is also an option for the customer to add a tip on the card machine when they pay. When we launched the tips feature at a coffee shop in Bree street, tips went up from 2% to 10% of card volume.

As always, we’d love to hear from you. Tweet us at @Yoco_ZA or connect with us on Facebook and Instagram.