Cash flow: the great equaliser. Whether you run an old-school ice cream truck, operate a nationwide mobile gardening service, or own a beloved fast-food joint, juggling rands and cents eventually keeps every business owner up at night. (Yup, even Mr I-build-rockets-’cause-I-can Musk). The thing is, you may be the best money manager this side of the JSE – you might even have been an accountant in a former life – but there’ll come a time when you’ll need money and your bank balance will beg to differ.

That’s where we come in. Instant Payouts and Yoco Capital are our answer to the age-old self-employed conundrum: where the heck am I going to get money to buy stock/open a new store/build a global empire/insert your business’s most pressing need here?

If you’re not sure what Instant Payout and Capital are all about. No probs. Here’s everything you need to know:

Instant Payouts: The solution to “Oh snap! I need my money ASAP” to pay staff, buy stock, pay rent, and all the other “can’t wait” business essentials.

It’s 11pm on a Sunday night and you’re snoring like you mean it – until a frantic text from the means-well-but-is-super-nosy Auntie who lives next door wakes you up “Hayibo! There’s a river running out of your garage!”. The same garage that houses all of your stock. You rush out of the door and lo and behold, she was right. The geyser has finally packed up, and a stream of water is snaking its way across the floor.

The damage is minimal – for now. The future of your business now rests in the callused hands of the only plumber prepared to venture out into the night.

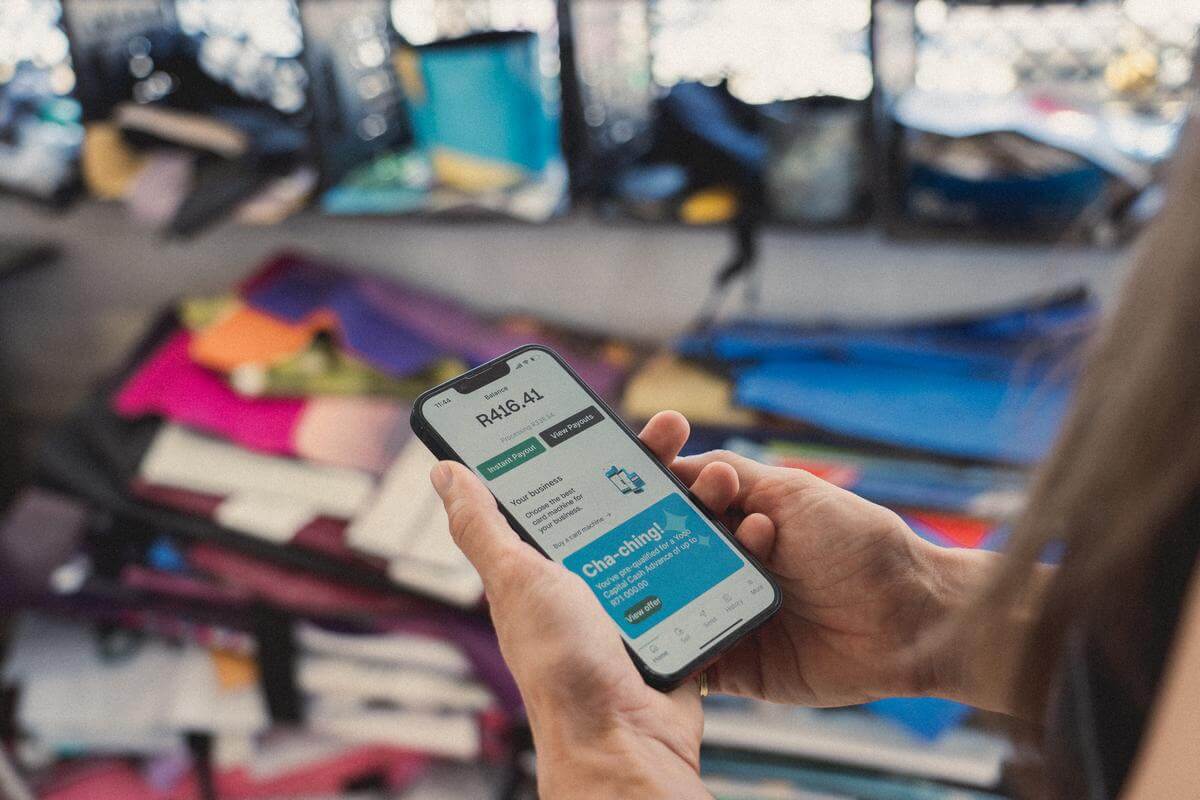

There’s one not-so-small problem though: he wants payment upfront. And while business has been booming over the last few days, your Yoco payout is only due on Tuesday. You’re stuck between a rock and a soggy concrete floor. That is, until you remember that Instant Payouts is now a thing. You open the Yoco App, click on ‘Instant Payout’ and mere minutes later, your money has landed in your bank account. You pay the plumber, the plumber does his plumber thing, and your business lives to see another day. Shew.

Think of Instant Payouts as a rescue buoy or a liferaft – it’s there to get you out of choppy waters and safely to shore.

It’s for those “Oh sh*t, I need to buy petrol for the generator but my sales from yesterday haven’t reflected yet.”* Instant Payouts is there to help you out in a pinch, giving you instant access to the money you’ve made – you can request as little as R50 and as much as R10 000 in a day – when you need it. If you’re an existing Yoco customer* (hey fam!), you can use Instant Payouts, accessible from the Yoco App. (Make sure you’re running the latest version!) Cool hey?

*This excludes customers using Yoco Capital

Want to know more? Read more over here!

Yoco Capital: A cash advance to take your business from good to great (without the debilitating debt, intimidating legal jargon, or a dreaded IRL visit to a bank).

Business is booming. In fact, your home-cooked Durban curries have become so popular that you’re seating six people at a table meant for two. Besides the demands of catering to a crowd every night, there’s another downside to your hard-earned success – for every patron who walks through the door, you have to turn another away.

But luck is on your side! Word on the street has it that the bespoke mask shop next door is closing (shame but also thank goodness #RIPfoggyglasses). The space is yours to rent if you want it. And you really, really want it. But your cash flow begs to differ. Until you’re scrolling through the Yoco App and see that you’re now eligible for Yoco Capital. Angels sing! Vuvuzelas trumpet! Happy dances are danced! And so the next phase of your culinary empire begins: in less than five minutes, you’ve applied for Capital. A few days later, the keys to the premises next door are yours, and the next chapter in your business begins.

(This scenario is loosely based on Banting Baker Gigi, who used Yoco Capital to scale her business due to demand. Read her story here.)

Yoco Capital is like a tugboat – it's there to give you an extra push, helping you navigate unfamiliar waters until you’re at your destination.

If you’ve got big dreams, but no funds to get you there, Yoco Capital might just be the solution. First thing’s first: Yoco Capital is not a loan (this is a good thing) Instead, it’s a cash advance that’s tailored to your unique business needs – which is also why there are a few qualifying criteria*. Once we see that you’ve met these requirements, we’ll send you an offer (fancy), that’ll magically appear in your Yoco App or Yoco Business Portal. Repayments are flexible – if sales are slow (or even stop completely for a month or two), your repayments do too. You pay one flat fee that’s calculated when you apply, and there are no fixed terms. (We’ll also never make you pay late fees). Instead of adding another reminder to the 27 post-its above your desk – we’ve kept things simple (and stress-free): your advance is automatically repaid every time you make a sale via Yoco. And! For the ultimate motivation, the more you sell, the more Yoco Capital is available to you. Apply in less than five minutes, entirely online (yup, there’s no face-to-face, “I have to wear my nice pants” nerve-racking meeting).

TL;DR? Here’s a handy table comparing Instant Payouts and Yoco Capital:

| Instant Payout | Yoco Capital | |

|---|---|---|

| What? | Your money in minutes | A cash advance |

| Who can use it? | All Yoco customers, excluding those making use of Yoco Capital. | Customers who meet our qualifying criteria* |

| For | Last-minute, “this can’t wait”, situations that require a quick fix. (Think buying more stock for the next day, paying staff, etc.) | Growing your business into an empire. (Think moving into a bigger premises, opening a new branch, upgrading equipment, etc.) |

| How much money? | R50 - R10 0000 per day (1 request per day; balance dependent) | R10 000 - R500 000 |

| When can I use it? | When you need it! (Except between 5 - 7am) | Once we make you an offer (Got questions? Ask our super-clever Capital bot here). |

Whether you’re ready to cash in on Instant Payouts or Yoco Capital, or, prefer to save this info for further down the road, we’d love to hear from you. Hit us up on socials with your thoughts on managing cash flow and financing your business.