Small business owners have a lot to worry about, but most concerns, like marketing, staffing, cash flow, and inventory, boil down to one key thing: finances.

Getting a grip on your finances can be particularly daunting for first-time entrepreneurs; after all, your cash flow is the lifeblood of your business. Without sound financial management, things can quickly spiral out of control and sink a new business.

That said, you don’t have to view financial management as a chore – a few simple, yet crucial steps taken early on can not only keep a new small business on its feet but provide a solid foundation for it to scale.

If you’re starting out as an entrepreneur, these seven tips will enable you to gain a firm grasp on your finances from the get-go:

1. Create a budget – and stick to it

When you have a great business idea, creating a business plan and a budget might seem like an unnecessary delay in getting yourself out there. It may not be the most exciting part of starting a small business, but creating a budget and then sticking to it is a crucial first step.

Without a business plan and a strict budget, it’s impossible to know what products you need to stock, how many of them you’ll need, how much they’ll cost you up front (and each month), and importantly, whether or not you can afford them in the first place!

Planning and regularly reviewing how you spend your business’s money will not only form the blueprint for your business, but will also help keep you on track and avoid making impulse buys and running up unnecessary expenses.

2. Get your records in order

As a first-time entrepreneur, you may think you can keep your records in order on the fly – after all, in the early days, you probably only need a few folders of your most critical spreadsheets. But meticulously organising information early on means that you’ll skip the panic of a chaotic system as your business grows – and possibly avoid any nasty (aka costly) surprises when it comes to tax season.

3. Track all your transactions

Keep track of your income and expenses (all of them!). This not only keeps your books in order for filing taxes, but also gives you crucial insight into the financial health of your business.

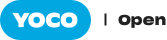

Although you might favour a head-in-the-sand approach when things are difficult, avoiding this admittedly boring but essential task won’t help in the long run. It doesn’t have to be a complex, manual process: a good point of sale system should, for example, track all your income and complete a daily, weekly, or monthly recon in seconds.

4. Regularly review your recurring costs

As a first-time entrepreneur, it’s tempting to load up on services and subscriptions that you feel will help you get your feet off the ground. Outsourced help, software and licensing fees, or even things like magazine and newspaper subscriptions might seem necessary – but before long, these recurring expenses can add up and start to eat a considerable chunk out of your cash flow. To stay on top of things, schedule a bi-annual review of these expenses. Cull those you no longer need, and scale back to cheaper or free versions of things that aren’t absolutely crucial.

5. Start slow, and build it up

It may be tempting to throw a lot of money at your problems or goals early on, particularly if you’ve landed upon a lump sum of cash or received donor funding. But first-time entrepreneurs should focus on keeping things lean and simple for as long as possible. Doing so not only streamlines your business and keeps you focused, but it’ll also help avoid overspending and other bad financial habits that will only worsen as you grow.

6. Keep cash flow steady

Cash flow makes or breaks a business – and a young company is particularly susceptible to cash flow issues. Having a decent amount of cash in the bank might seem like a pipe dream early on, but it’s crucial to keep working on a healthy cash flow – plus some reserves. What’s more, banks will be more likely to lend you money, and investors will be more likely to trust you if they can see your business is maintaining a healthy cash flow. Plus, it’ll also help you to scale when times are better.

Exactly how you maintain good cash flow depends on the nature of your business – but keeping this as a focus and ensuring you have up to date records of your income and expenditure is a crucial place to start.

7. Manage your taxes – or get help from a pro

Sound financial management is crucial for many aspects of your young business – it can help you stay focused, fine-tune your operation, and know when you’re growing and when you need to make changes. But it’s also critical to keep your business on the ride side of the taxman.

Tax might not seem important when you’re only selling a few cups of coffee or cutting a few heads of hair a day. But come tax season, especially when your business grows up, it’s a whole different story.

The best financial management plans keep taxes in mind from the outset – but it’s not something you should worry about alone. Hire a bookkeeper who’s an expert in this field. A good bookkeeper ensures you pay the right amount of tax at the right time and can also offer expert advice and support when making important financial decisions for your business.

Managing your money like a boss may seem daunting if you’re new to the entrepreneurial game, but by following the seven tips outlined above, you’ll grow your money management muscle, one rand at a time.

Want to simplify your business operations? Sign up with Yoco today and get access to our all-powerful Portal: our free, smart software that enables you to manage your day-to-day sales, inventory, and staff.