Running an SME business in a country like South Africa has never been as exciting as it is today and it’s also an exciting time for new businesses. But starting a business does come with more than its fair share of challenges. One of the big ones is how to get business funding when you need it.

In a Yoco Small Business Pulse survey to 3 621 businesses across South Africa, half of the business owners said that access to capital is important for their success. Contrast this with the 74% of businesses who were unsuccessful in getting the capital they applied for.

We want to make getting a cash advance easier for SME businesses in South Africa.

As of October 2018, Yoco has dispersed over R7.3m business funding to 225 businesses. We understand that it is an important part of making sure that your business grows. So our mission is simple: make growing a business as easy as possible.

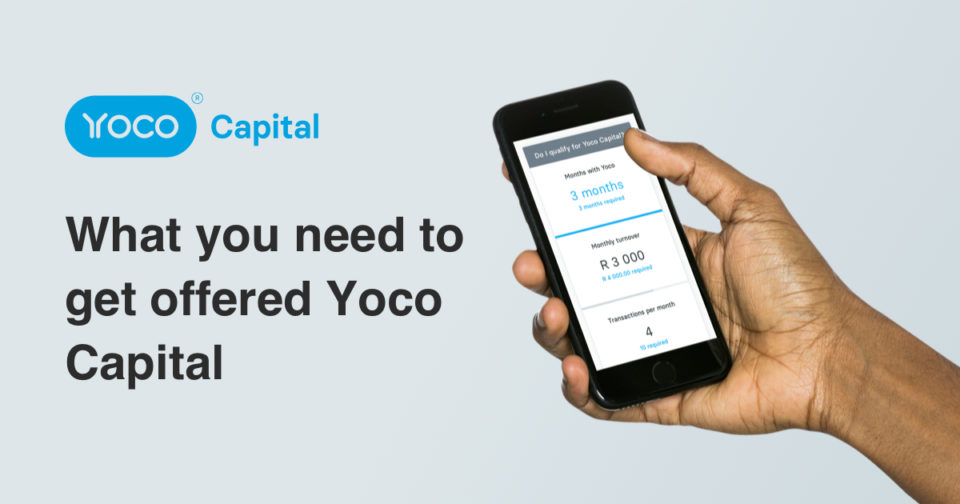

What you need to get offered Yoco Capital:

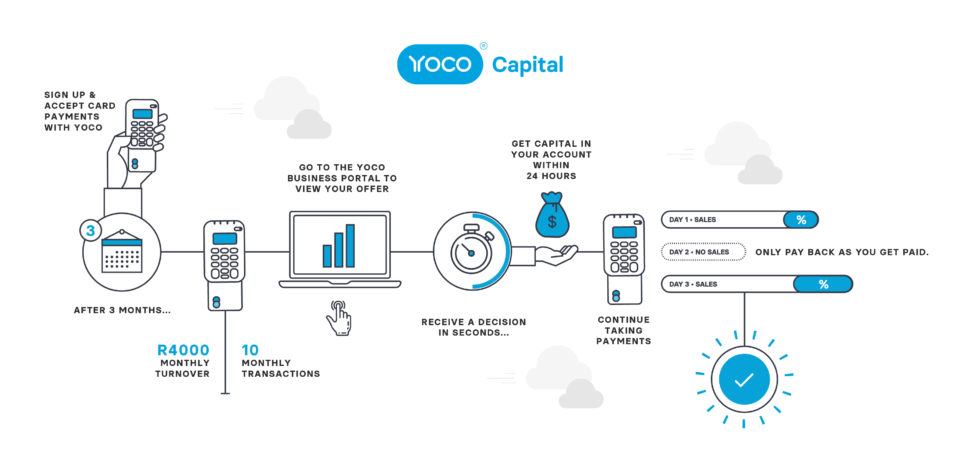

1. You have to be a Yoco merchant for at least three months.

This is because we use your Yoco account history and monthly turnover to work out your cash advance offer.

2. Your monthly turnover needs to be more than R4 000.

Your cash advance offer can be up to 80% of your monthly sales. If your sales increase, your access to funds increases.

3. You need to make at least ten transactions per month on your Yoco card machine.

Your cash advance is automatically paid back as a percentage of your daily Yoco card sales. The more you swipe, the faster you pay back your cash advance. It’s that simple.

And that’s it.

All you have to worry about is getting on with business as usual.

Eligible Yoco merchants receive an email and a notification in their Yoco Business Portal with the cash advance offer.